Want to know if you qualify for a Labor Day Stimulus Checks 2024 and how much you could get? Stimulus checks are direct payments from the U.S. government, offering crucial financial support during tough times like the COVID-19 pandemic. With three major rounds of payments, including a new $1,400 boost for new parents, there’s a lot to uncover. Learn how to track your payment status and what to do if you missed previous checks. Ready to find out more? Stay tuned with us and learn exciting details about stimulus checks.

Table of Contents

$1400 Labor Day Stimulus Checks 2024

Stimulus payments are vital for many individuals, offering financial stability through one-time payments. In September 2024, eligible individuals in the USA can expect to receive a $1,400 direct deposit payment, commonly referred to as a stimulus check. This payment is part of the ongoing efforts by the Internal Revenue Service to provide financial assistance to residents with lower wages.

Specifically, new parents who welcomed a child in 2021 are entitled to this payment, even if they do not owe any taxes. The IRS will manage the distribution of the $1,400 stimulus check payments. Here is everything you need to know about the $1,400 stimulus checks on Labor Day.

What Is A Stimulus Check?

Stimulus checks are money that the U.S. government gives directly to American families, especially during times like the COVID-19 pandemic.

Throughout the pandemic, three separate rounds of stimulus checks were sent out to help people cope with financial challenges.

| Stimulus Check | Act | Date Authorised | Amount per Eligible Adult | Amount per Eligible Dependent Child |

| 1 | CARES Act | March 2020 | Up to $1,200 | $500 |

| 2 | Additional Stimulus Check | December 2020 | Up to $600 | $600 |

| 3 | American Rescue Plan Act | March 2021 | Up to $1,400 | Up to $1,400 |

Who Gets A Stimulus Check?

The COVID-19 stimulus checks were issued to eligible individuals in the U.S. based on Social Security numbers. Initially, those claimed as dependents on tax returns couldn’t get their own payment, except for those with dependents under 17 who qualified for additional funds. The criteria expanded with the third check, allowing payments for adult dependents and dependents over 17.

Income limits were also crucial. Single filers earning under $75,000 annually, heads of households under $112,500, and married couples filing jointly under $150,000 qualified for the full amount. Phase-outs, where eligibility decreased for higher incomes, varied for each payment round.

| Social Security Benefits Should Not Be Taxed |

| Centrelink 50000 Bereavement Payment |

| Ontario Teacher Pension Plan |

| Max Spx 500 4x Leveraged Etns |

| 1500 Oas Payments 300 Extra For Seniors In July 2024 |

Key Facts

- Bank of America’s analysis highlights that the significant one-year change is largely due to the economic downturn caused by lockdowns and business closures early in the coronavirus pandemic.

- The report demonstrates the impact of stimulus checks on consumer spending: recipients of government aid spent 49% more compared to the same week two years ago, whereas those without aid spent only 9.7% more than they did two years ago.

- The majority of spending increases last week came from low-income individuals. Those earning under $50,000 annually and who received stimulus aid spent 69% more than they did two years ago, while high-income individuals receiving aid spent 29% more than they did two years ago.

- Stimulus check spending led to the largest gains in categories such as furniture, online electronics, and clothing.

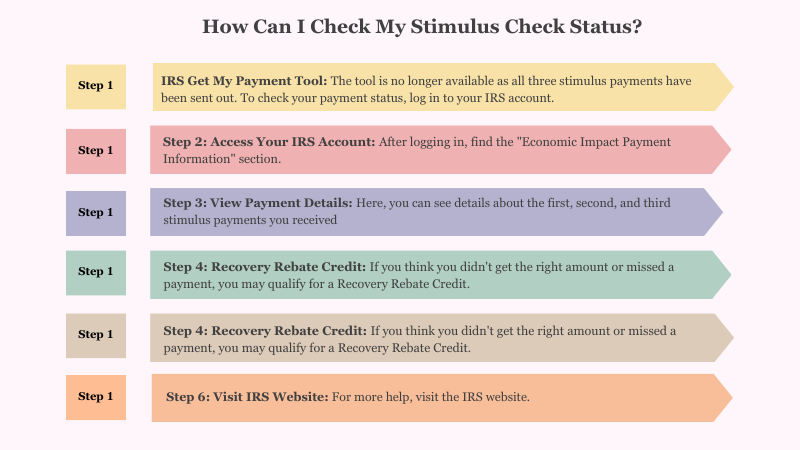

How Can I Check My Stimulus Check Status?

How Much Will My Stimulus Checks Be?

The amount you receive in COVID-19 stimulus checks depends on your family situation and income.

Which States Are Getting Stimulus Checks?

Here are 19 States Are Sending Out Stimulus Checks: Explore more

Let’s know about latest Stimulus Checks for USA Citizens

Labor Day 2024: $1400 Stimulus Checks for USA Citizens

New parents who had a child in 2021 are eligible for a $1,400 stimulus payment, regardless of whether they owe taxes. The IRS will handle the distribution of these payments. Here’s what you need to know:

- Eligibility: New parents of a child born in 2021.

- Application: No application required if you’ve already filed your taxes; the IRS will distribute the payment automatically.

- Deposit Date: Expected in September 2024.

| Nova Scotia Income Assistance |

| 1405 Pension Payment |

| Cpp Payment Dates 2024 |

| 628 Grocery Rebate In Canada |

| Ato Payment Plan 2024 |

Key Information on Stimulus Payments

Stimulus payments offer vital assistance to eligible individuals and families, including new parents who may have encountered higher expenses due to having a child or other financial hardships. To receive the $1,400 stimulus payment, individuals need to meet specific criteria.

$1400 Labor Day Stimulus Checks Eligibility

The stimulus payments provide crucial support to eligible individuals and families, including new parents who may have faced increased expenses due to the birth of a child or other financial challenges. To qualify for the $1,400 stimulus payment, individuals must meet certain criteria.

- Residency and Citizenship: The applicant must be an American citizen residing in the U.S.

- Age Requirement: There is no specific age requirement mentioned, but typically, stimulus checks are available to adults who meet all the eligibility conditions.

- Income Threshold: The recipient’s annual income should not exceed $75,000. For married couples filing jointly, their combined income must be $150,000 or less to qualify.

- Social Security Number: It is mandatory to hold a valid Social Security Number.

- Tax Filing: Applicants must have filed their taxes by May 17, 2024.

These criteria ensure that the labour day Stimulus Checks $1400 reach those most in need based on residency, income level, and tax filing status.

Additional Benefits

In addition to stimulus payments, you may qualify for other benefits such as:

- Child Benefit Payments

- Cost of Living Payment

- Housing Benefit

- Worker Benefit Payment

Each benefit has specific eligibility criteria and offers additional financial assistance. Meeting these requirements can help alleviate financial pressures and offer valuable relief during difficult circumstances.

For More Information : Visit irs.gov

What If You Missed Previous Stimulus Payments?

If you missed previous stimulus payments, there’s no need to worry. You can still claim the Recovery Rebate Credit, which allows you to receive financial assistance for any missed payments provided by the government.

To secure this support, ensure you meet the eligibility requirements and update your tax information as necessary. The IRS is preparing to distribute the $1400 Stimulus Checks on Labor Day in September 2024, according to recent media reports. Eligible individuals, particularly new parents who filed their taxes by May 17, 2024, should anticipate receiving their payments during this period.

Recent News on $1,400 Stimulus Checks

While the topic of $1,400 stimulus checks garners significant interest, it’s important to rely on official updates for accurate information. Currently, no new stimulus package has been confirmed. If a new package is approved, the government will clearly outline the eligibility criteria and distribution timeline.

The main objective of this financial aid is to provide immediate relief to households experiencing economic hardship. By infusing cash into the economy, the government hopes to encourage consumer spending, assist companies, and avert possible downturns such as mass evictions and company closures.

The $1,400 stimulus checks are a crucial element of the government’s strategy to assist low-income households during these challenging times. With distribution planned for Labor Day, eligible recipients should be prepared to receive this assistance, which is designed to help cover essential expenses and stimulate the broader economy.

Conclusion

In conclusion, Labor Day Stimulus Checks 2024 marks a pivotal moment for eligible Americans to receive crucial financial support through the $1400 stimulus check. Whether you’re a new parent or facing financial challenges, understanding eligibility criteria and staying informed about payment status is vital. Remember, if you missed previous stimulus payments, you can still claim the Recovery Rebate Credit. Stay proactive, verify payment details through official channels, and ensure you receive the financial assistance you’re entitled to during these challenging times.

FAQs

What would I do if I didn’t receive my stimulus check?

If you didn’t receive your stimulus check, you should first check your payment status on the IRS website. If it shows as issued but you didn’t receive it, you may need to claim the Recovery Rebate Credit by filing or amending your tax return.

How Many Stimulus Checks Were Issued Per Person?

Each eligible individual could receive up to three stimulus checks during the COVID-19 pandemic.