$3600 Biden Stimulus Checks: President Biden’s 2024 budget proposal brings significant reforms aimed at supporting American families, with one of the most impactful changes being the enhancement of the child tax credit. Under this proposal, the credit would increase from $2,000 to $3,600 for each child under six years old. This adjustment is designed to provide substantial financial relief to families with young children, helping to alleviate the costs associated with raising a family.

The proposal’s potential benefits are substantial, but its path to approval and the specifics of eligibility remain critical factors to watch. This article will explore what these proposed changes entail, the likelihood of the proposal’s approval, and who stands to benefit from this increased tax credit.

Table of Contents

What is the $3600 Biden Stimulus Checks?

The $3600 Biden Stimulus Checks are a proposed measure aimed at providing significant financial relief to American households, building on previous economic aid efforts. This proposal suggests delivering a substantial one-time or recurring payment of $3600 per eligible individual to help cover essential expenses and support economic stability amid ongoing financial challenges.

Eligibility for these checks typically hinges on income thresholds, with payments targeted towards those earning below specific limits. Families with dependents may also receive increased amounts. The proposal must navigate the legislative process, including debates and approval in Congress, before it can be implemented.

Chances of Approval

The proposed budget features numerous benefits aimed at supporting American families, including reductions in health and housing costs, lower prescription drug prices, and expanded access to affordable healthcare. However, the approval process for the budget is complex, taking into account factors like the nation’s financial status and available resources.

There is no guarantee that the entire budget will be passed as proposed. Some elements may be approved, while others might be rejected. Should the budget be approved, the government will then announce the finalized benefits and any modifications made to the initial proposal.

| Ira Contribution Limit 2024 |

|---|

| 1400 Checks And 300 Weekly Payments |

| Disability Benefits Arrival Dates |

| Social Security Disability Benefits Pay Chart 2024 |

| Australia Minimum Pension |

Eligibility Criteria : Biden Stimulus Checks Who Qualifies

Income Thresholds

| Filing Status | Income Threshold | Eligibility Details |

|---|---|---|

| Single Filers | Below $75,000 per year (example) | May qualify for the full $3600 stimulus check. Benefits may phase out for incomes above this threshold. |

| Married Couples | Below $150,000 per year (example) | May qualify for the full $3600 stimulus check. Benefits may phase out for incomes above this threshold. |

Household Size

| Category | Eligibility Details |

|---|---|

| Dependents | Families with dependents (children under 17) are typically eligible for additional benefits. The proposal may offer the full $3600 check for each dependent or an increased amount for larger households with more children. |

| Head of Household | Individuals filing as head of household may qualify. Income thresholds are generally set somewhat lower compared to those for married couples filing jointly. |

Tax Filing Status

| Tax Filing Status | Eligibility Details |

|---|---|

| Tax Returns | Individuals must file a federal tax return to qualify. The stimulus check amount is based on the most recent tax return information (typically from the previous year). |

| Non-Filers | Provisions may include non-filers or individuals with minimal income who do not usually file taxes but still need assistance. These individuals may need to file a return to claim the stimulus check. |

Citizenship and Residency

| Citizenship and Residency | Eligibility Details |

|---|---|

| U.S. Citizens | Generally eligible for the stimulus checks. |

| Legal Permanent Residents | Green card holders are typically eligible for the checks. |

| Certain Visa Holders | May qualify depending on specific legislative details and visa status. |

Income Verification

| Income Verification | Eligibility Details |

|---|---|

| Adjusted Gross Income (AGI) | Eligibility is determined based on AGI reported on tax returns. Individuals with AGI below the specified thresholds may qualify for full or partial payments. Those with AGI above the threshold may receive reduced benefits. |

Special Considerations

| Special Considerations | Eligibility Details |

|---|---|

| Social Security and Disability Recipients | Individuals receiving Social Security benefits or disability payments often qualify for stimulus checks, even if they do not file tax returns. |

| Other Government Benefits | Eligibility may extend to individuals receiving other forms of government assistance, such as veterans’ benefits or unemployment insurance. |

Key Points to Remember

- Phase-Out Mechanism: The stimulus check amount may phase out as income increases, meaning individuals with incomes above the thresholds might receive reduced amounts.

- Verification: The IRS typically uses tax return data or information from other federal agencies to verify eligibility and determine payment amounts.

Other Key Aspects of Biden’s Budget

In addition to the increase in the child tax credit, President Biden’s budget proposal includes several other notable initiatives:

- The reduction of expenses for parents and workers who have children.

- Reducing prescription drug prices.

- Expanding access to affordable healthcare.

- Lowering housing, home energy, and water costs.

- Enhancing border security and immigration enforcement.

- Promoting integrated deterrence on a global scale.

- Transforming behavioral healthcare.

- Investing in high-poverty schools.

- Cutting global warming and pollution.

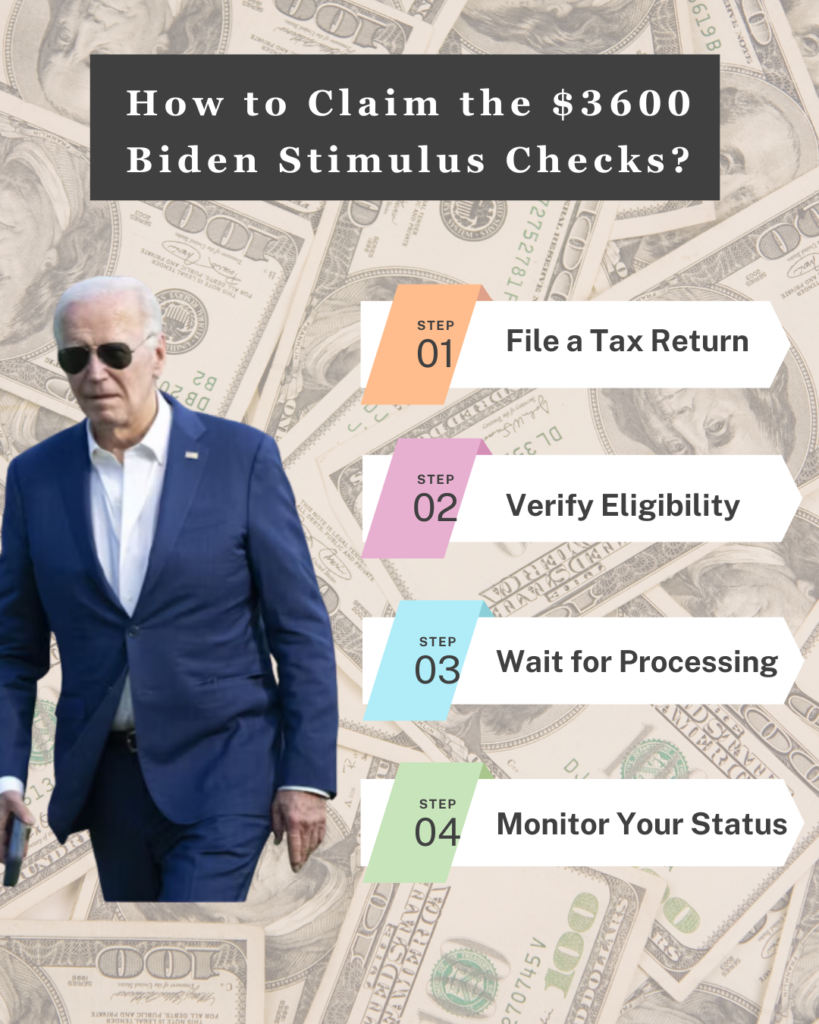

How to Claim the $3600 Biden Stimulus Checks?

Step 1: File a Tax Return

Ensure that you have filed a federal tax return for the most recent tax year. Eligibility for the stimulus check is typically determined based on the information provided in your tax return. If you are not required to file taxes due to low income or other reasons, you may still need to file a return to claim the stimulus check.

Step 2: Verify Eligibility

Check that you meet the income and eligibility criteria specified for the stimulus check. This includes verifying that your income falls below the required thresholds and that you meet the criteria for dependents and filing status.

Step 3: Wait for Processing

Once the proposal is approved and the checks are issued, the IRS will process payments based on the information from your tax return. Eligible individuals will receive the stimulus check automatically via direct deposit, a mailed check, or other distribution methods used by the IRS.

Step 4: Monitor Your Status

Keep track of official IRS updates and communications regarding the stimulus checks. If you do not receive your check within the expected timeframe, use the IRS’s online tools or contact them for assistance.

Conclusion

The $3600 Biden Stimulus Checks represent a substantial step in supporting American families, particularly those with young children, by increasing the child tax credit. While the proposal promises significant financial relief, its approval and implementation depend on legislative processes and budget negotiations. Eligible individuals will need to file their tax returns, verify their eligibility, and then wait for the IRS to process and distribute the checks. Staying informed through official channels will ensure you receive the benefit in a timely manner.

FAQs

When will the $3600 stimulus checks be available?

Availability depends on the approval and implementation timeline of the budget proposal. Check official IRS updates for specific dates.

Do I need to apply for the $3600 stimulus check?

No, eligible individuals will automatically receive the payment based on their tax return information.

What if I don’t normally file taxes?

You may still need to file a tax return to receive the stimulus check, even if you are not usually required to file.

How will I receive the stimulus check?

Payments will be issued via direct deposit, a mailed check, or other methods used by the IRS.