Golden State Stimulus is a program that was launched by the California government to help low-income families who were affected by the COVID-19 epidemic.

The program included two phases: Golden State Stimulus I and Golden State Stimulus II. It provided financial assistance to residents who were eligible.

There are currently no Golden State Stimulus Checks planned for 2024. False claims that a Golden State Stimulus Check will be issued in 2024 have been made.

Table of Contents

Program Overview

| Program | Details |

|---|---|

| Name | Golden State Stimulus |

| Types | GSS-II |

| State | California |

| Payment Amount | From $500 to $1200 |

| Eligibility | Based on 2020 tax returns, low-income individuals |

| Official Website | www.ftb.ca.gov |

| Payment date for 2024 | Not Announced |

Golden State Stimulus Payments Overview

GSS-I and GSS-II Payments

Golden State Stimulus Checks were divided into two categories.

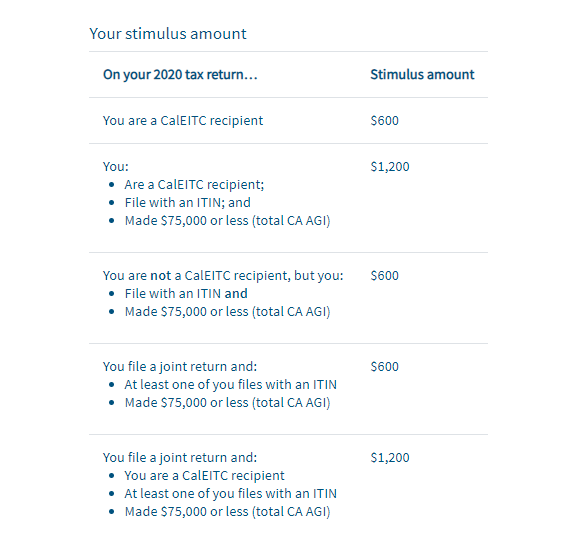

- GSS I: Payments ranging from $600 to $1200.

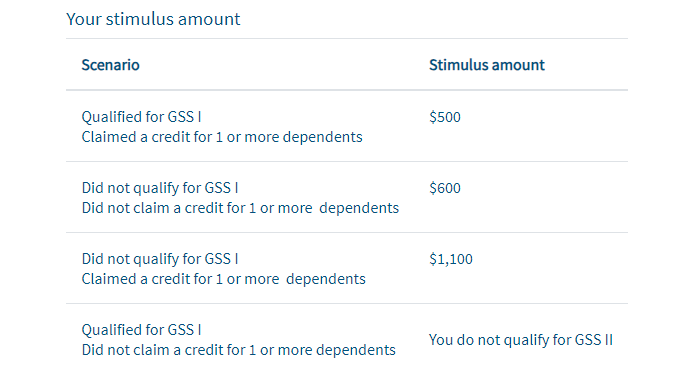

- GSS II: Payments ranging from $500 to $1100 depending on eligibility criteria

The payments are based on the 2020 tax returns, and they were targeted at people with low incomes. The official website of the Franchise Tax Board is www.ftb.ca.gov. You can find all announcements and updates about the stimulus checks.

| 2600 Stimulus Checks |

| 1800 Social Security Checks |

| Verizon Settlement Payout Date |

| Verizon Class Action Lawsuit |

| 550 And 2400 Stimulus Checks |

| 300 Child Tax Credit Update 2024 |

Current Status

The Golden State Stimulus has completed both phases. There are no new checks scheduled for 2024. Rumors of new payments are false and should be checked with the FTB. It is important to keep up-to-date on any updates through the official channels.

GSS I and GSS II Eligibility Criteria for 2024

FTB California has all eligibility criteria for Golden State Stimulus 2024. There are two types of Golden State Stimulus Checks. Each has different eligibility criteria. GSS I is available to most individuals and families, while GSS II requires additional requirements. Golden State Stimulus I – Check the amount.

Prior to October 15, 2021, in order to be eligible for GSS II, an individual had file his or her 2020 tax return, reside in California, and be either a CalEITC recipient or ITIN filer with an income of $75,000 or less. GSS II is only open to California residents who have wage ranges between $0 and $75,000 and CA AGI between $1 and $75,000.

Golden State Stimulus II – Amount

FTB California will announce the new guidelines for Golden State Stimulus I and II on its official website. The paper checks are delivered in approximately 3 weeks after they have been mailed. Residents can also call the FTB California helpline or send a letter to the address.

Payment Dates for Golden State Stimulus Checks

Franchise Tax Board (California) will provide the payment dates for 2024. Payment dates are the exact dates on which the authorities will deliver the required stimulus amounts. Golden State Stimulus amounts vary depending on the scenario. After the checks are mailed, it will take several days for them to reach the intended recipient.

The information states that the payment or check will be sent based on the last three digits in the pin code of the specific area. The GSS checks, for example, were previously sent between October 6, 2021, and October 27, 2021, with the pin code 000-044. The payment dates for the entire period are determined by the last three digits of the pin code of the area, which can be found on the FTB California authorized website.

Stay informed

Always refer to the official site of the Franchise Tax Board for accurate information ( www.ftb.ca.gov). This website provides information on the most recent updates, eligibility tools and detailed guidelines regarding past and future stimulus payments.

Fact Check on 2024 Stimulus

There have been no official announcements about the Golden State Stimulus for 2024. Information indicating otherwise is speculative. Verify the accuracy of any information by contacting FTB official resources.

Golden State Stimulus provided crucial financial support to low-income families in the midst of the pandemic.

Even though both phases are over, it is important to stay informed about any updates through official channels. For accurate and up-to-date information, consult the website of the Franchise Tax Board and financial experts.

FAQs

Is a Golden State Stimulus check scheduled for 2024?

There are no Golden State Stimulus Checks planned for 2024.

What was the amount of payment for GSS-I and GSS-II?

GSS-I payments can range from $600 up to $1200 and GSS-II from $500 up to $1100.

Who is eligible for Golden State Stimulus Checks?

The eligibility was determined by residency, income, tax returns and an ITIN.

What are the latest updates regarding the Golden State Stimulus?

Visit the official site of the Franchise Tax Board by visiting www.ftb.ca.gov.